Junk Debt Buyers

Years ago most consumers with old defaulted debts stopped worrying after several years. Most creditors stopped trying to collect after a short while, especially when it was a small amount of money. But today purchasing and collecting old debts has become a booming and profitable industry. Old accounts once thought to be uncollectible are now considered to be of great value. Recovering even a small payment from debtors on these old debts (also know as “zombie debts” or “time barred debts”) can make collection efforts profitable. If you are being contacted about an old zombie debt, contact a debt help lawyer immediately.

These zombie debts, also known as “junk debts,” are the bread and butter for an entire junk debt buying industry. These junk debts change the collections model from “contingency” collections (agencies work as agents for another company to collect a debt) to collection agencies owning bad debt and working for themselves to collect.

Charged Off Junk Debts Are Still Collectible

Aggressive collection agencies and companies can buy charged-off credit card accounts from the original lenders for pennies on the dollar. They use advanced technologies and credit scoring to target debtors that are more likely to repay. This makes junk debt buying a multi-billion dollar industry responsible for a large number of debt collection and credit reporting violations.

The IRS allows creditors to charge off debts that have become worthless and sell them to these junk debt buyers. In a nutshell this rule allows creditors to take a loss on their income taxes when a debt they are trying to collect becomes worthless, while allowing someone else to collect. Companies do not actually have to go to court to prove the debt is uncollectible and they can still try to collect the debt at a later date.

If you receive collection calls or notices on charged off debts that you have already paid off (either before or after the charge-off) then immediately dispute the debt in writing using this free sample letter.

Junk debt buyers love charged off debts

Sometimes creditors will try to collect the debt for a few months, and in rare cases as long as a few years. They’ll do this through an in-house collection department or by hiring a third-party collection agency. When they hire debt collectors, the creditor retains legal rights to the account and the bill collector must act on behalf of the original creditor.

More often creditors sell accounts they deem to third party junk debt collection agencies. When they sell the account they sell all rights to the account as well. Delinquent debts accounts are bought and sold and resold so your old account might end up in the hands of a dozen different debt collectors over the course of several years. This explains why you receive out-of-the-blue harassing phone calls from debt collectors demanding payment on an old forgotten debt.

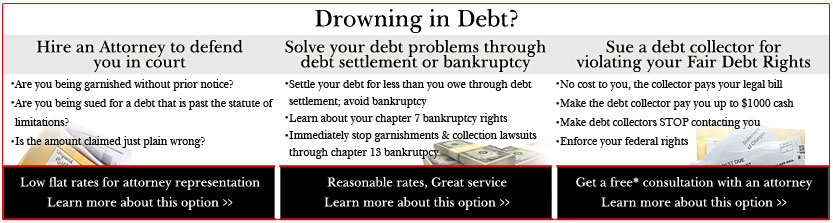

The backlash of all this collection activity is potential and frequent violations of the Fair Credit Reporting Act, the Fair Debt Collection Practices Act, the Truth in Lending Act as well as other must know federal consumer protection laws. Our attorneys could help you stop the harassing debt collection phone calls, threatening debt collection letters and negative credit reporting from Zombie Debt Collectors even if you do owe the debt! There are several things to watch for when being contacted by junk debt buyers.

Re-aging Accounts

Debt reporting re-aging is the practice of reporting a bad debt account as more recent than it really is. Re-aging causes the FICO score to drop dramatically since the scoring model interprets the re-age as a more recent default. Junk debt buyers attempt to force settlement on “time barred” or “Expired Statute of Limitations” accounts. The actual date that the debt becomes delinquent is supposed to be reported to credit reporting agencies under FCRA/FACTA within 90 days of the delinquency. This includes mis-marking the “open date” or “date of last activity” on an account, wherein Zombie debt collectors may attempt to tell credit bureaus that an old debt is a new one which extends the seven-year limit on reporting negative items.

WARNING! It does not improve a credit score to settle an old debt unless the item is completely deleted (not just reported as “paid in full”). Settling a debt with a junk debt buyer makes your credit score worse because the delinquency or charge-off will now be reported as more recent!

Multiple Listings of the Same Debt

Junk debt buyers are often responsible for multiple reporting of the same debt as these change hands among buyers and sellers. Usually, these same debts are reported by the original creditor as well. Thus you could have the same debt reported multiple times! You can increase your credit score by properly disputing your credit reports. Also, a junk debt may be passed to more than one agency to collect at the same time.

WARNING! Agreeing to pay a zombie debt is also no guarantee that the debt will come off your credit report as the original owner can still report it no matter what you agree to with the collector.

Suing or threatening to sue for a debt that is past the statute of limitations

Junk debt buyers often press for payment of some small amount, just to bring the debt back under the statute of limitations. The unpaid debt could once again be sold to another company that might renew collection activity. It is important to note that State statute of limitations (SoL) for collections are different from FCRA/FACTA statutes of limitations for reporting the debt on your credit report. Also, junk debt buyers purchase debts that are outside the statute of limitations for lawsuit (legal enforcement of the debt) but not outside the statute of limitations for reporting the debt on your credit report! They like to report this debt as a revolving account, which is illegal but puts the debtor under even more duress and pressure to pay.

WARNING! Payment can revive the statute of limitations, which was up prior to this activity, and lead to a lawsuit.

What if you are contacted by a junk debt buyer?

There are some truly prolific Junk Debt Buyers (some of which may be owned in part by others), many of which buy tens of millions of dollars in delinquent accounts for fractions of a percent. If are contacted by one of these agencies or you see these names on your credit report or are, there are some things to know, including how to contact a Debt Help Lawyer.

- Don’t assume you are wrong – assume instead that your rights are being violated, and even if you get the collector to promise something in writing, you have to be willing to go to court if the agency reneged.

- Keep all letters, account statements, and court records (even from 15 years ago)

Do not provide the collection agency or junk debt buyer with updated personal information - Never acknowledge a debt with a collector or agree to any payment until the collection agency “validates” the debt (past billing statements are not considered proof)

- Never accept credit card “offers” that come with an offer to settle a debt or that request payment in any other way

- Monitor your credit reports and get your free annual credit report!

- If the statute of limitations hasn’t expired, you may want to negotiate a settlement rather than risk a lawsuit, contact a Fair Debt Collection Lawyer today for a free consultation.

- If the collector persists in its deception, you can demand that the collector produce a copy of the documentation that created the debt, such as the credit card agreement you originally signed, along with an account history. Chances are the collector won’t have this documentation, and continuing to report the account without providing proof that you owe the money is a violation of several laws.

Some of these junk debt buyers include:

- Asset Acceptance

- Encore Capital Group/Midland Credit Management/Midland Funding

- Sherman Acquisitions/Sherman Financial Group/Resurgent Capital/Alegis

- LVNV Funding

- Portfolio Recovery Assoc

- Asta Funding

- Allied National/Interstate Risk Management Alternatives (RMA)

- Cavalry Portfolio Services

- Unifund Group

- Oliphant Financial Corp.

- OSI Portfolio Services (part of the NCO Group)

- JBC & Associates

- Jefferson Capital Systems

- RJM Acquisitions

- CAMCO (Capital Acquisitions & Management Company)

- Excalibur

- Phoenix Asset Acceptance

- First Select Corporation (part of Providian)

- Collins Financial Services